Blogs

The latest cybersecurity trends, best practices, security vulnerabilities, and more

Trellix’s Differentiated Position in the XDR Market - Highlighted in Industry Reports and Customer Reviews

By Daniel Ramos and Trellix · January 30, 2023

This story was also written by Kathleen Trahan.

In this blog, we present findings about Trellix’s differentiated position based on the aggregated representation of our XDR and native security tools in industry reports and peer review programs published by Gartner, Forrester, and IDC in the last 18 months.

Our analysis demonstrates how Trellix integrates, correlates, and contextualizes the highest number of native security tools which add up to a greater whole compared to what any other vendor provides on their own or through a 3rd party.

For reference, Trellix native security tools are technologies that collect security telemetry, or event data to integrate into the XDR platform, providing a simplified and insightful Security Operations experience to rapidly understand and stop attacks. These native security tools include endpoint security, network security, data protection, cloud security, and email security.

In addition to the integration of its native security tools, Trellix offers third-party integrations from more than 1,000 data sources, making it one of the only vendors offering an optimal hybrid XDR integration approach (both native and open) with key critical native security tools to gain the best outcomes and remove disruptions and additional workloads.

What are Trellix’s unique differentiators highlighted across Gartner, Forrester, and IDC sources?

Since the creation of Trellix brand in January 2022, we started consolidating our participation in the Industry Reports and Peer review programs related to XDR and native security tools, allowing us to identify what we see as our top four key differentiators against all other XDR vendors.

| Trellix Key Differentiators | Why this matter? |

|---|---|

| 1. Trellix is the XDR vendor that meets the market definitions and product criteria specific to the highest number of XDR and security tools related reports published by Gartner, Forrester, and IDC in the last 18 months. |

Trellix consolidates the highest number of native security tools providing:

|

| 2. Trellix is the XDR vendor with the highest number of reviews for the security tools on Gartner Peer Insights. |

|

| 3. Trellix is the 6th largest security software vendor for the aggregated revenues in the Market Share Analysis: Security Software, Worldwide, 2021) |

|

| 4. Trellix is the 3rd largest Modern Endpoint Security vendor in the IDC Worldwide Modern Endpoint Security Market Shares, July 2021–June 2022. |

|

How is Trellix represented across Gartner, Forrester, and IDC industry reports?

Every year, the analytical firms establish new criteria for their report inclusion, based on market technical requirements, vendor offerings, and performance in the market (e.g., vendor’s market share, number of clients, installed base, etc.). This criterion helps narrow the scope of the research to vendors these analytical firms consider to be best suited to the evolving needs of their clients as buyers in the market.

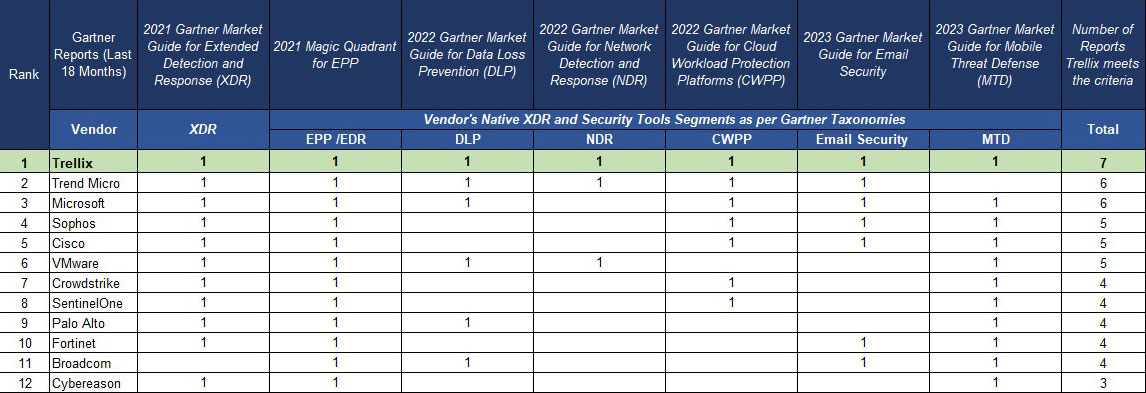

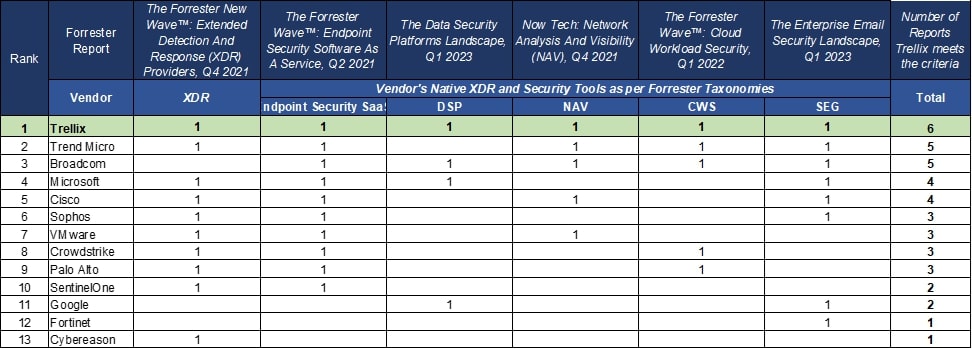

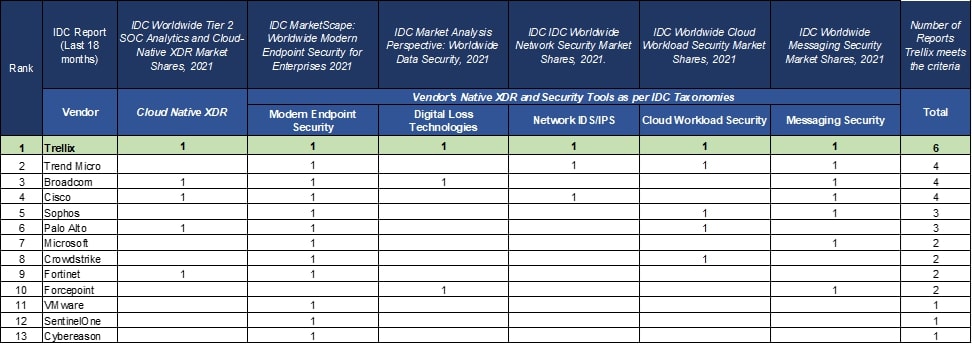

Based on the industry reports published by Gartner, Forrester, and IDC in the last 18 months we created the following tables to show Trellix’s top position in terms of the number of inclusions across these reports. Trellix is the XDR vendor that meets the market definitions and product criteria specific to the highest number of XDR and security tools reports published by Gartner, Forrester, and IDC in the last 18 months.

Number of inclusions in Gartner reports: XDR vendors (July 2021-February 2023)

Number of inclusions in Forrester reports: XDR vendors (July 2021-January 2023)

Number of inclusions in IDC reports: XDR vendors (July 2021-January 2023)

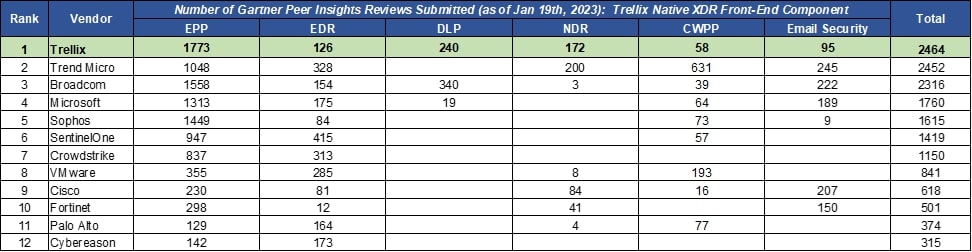

How is Trellix represented on Gartner Peer Insights?

In the last few years, Gartner has moved towards consolidating its Peer Insights program to offer a balanced representation of vendors to support end-users in their selection process. All Gartner Peer Insights reviews go through a strict moderation and validation process. Reviews cover product capabilities and the entire technology life cycle including evaluation, implementation, and service & support.

The following table demonstrates Trellix’s top position for user reviews based on real-world implementations of products and moderated for authenticity by Gartner Peer Insights:

Trellix’s ongoing commitment to support customers

Trellix is committed to continue its participation in the industry report research processes and Peer Review Programs to provide customers objective market perspectives and verifiable peer reviews to streamline our customer’s and prospect’s path to better technology purchasing decisions.

RECENT NEWS

-

Feb 10, 2026

Trellix SecondSight actionable threat hunting strengthens cyber resilience

-

Dec 16, 2025

Trellix NDR Strengthens OT-IT Security Convergence

-

Dec 11, 2025

Trellix Finds 97% of CISOs Agree Hybrid Infrastructure Provides Greater Resilience

-

Oct 29, 2025

Trellix Announces No-Code Security Workflows for Faster Investigation and Response

-

Oct 28, 2025

Trellix AntiMalware Engine secures I-O Data network attached storage devices

RECENT STORIES

Disclaimers:

Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, express or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Gartner, Magic Quadrant, and Market Guide are registered trademarks and service marks of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences with the vendors listed on the platform, should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose.

Sources:

IDC Market Analysis Perspective: Worldwide Data Security, 2021 | Frank Dickson, Oct 2021 - Market Analysis Perspective - Doc # US48323321.

IDC Market Analysis Perspective: Worldwide Cloud Workload Security, 2022 Philip Bues, Sep 2022 - Market Analysis Perspective - Doc # US49669822.

IDC Worldwide Tier 2 SOC Analytics and Cloud-Native XDR Market Shares, 2021: Rethinking the Cybersecurity SOC Software Stack Christopher Kissel | Monika Soltysik | Frank Dickson | Michelle Abraham, Oct 2022 | Market Share Doc | #US49128123.

IDC Worldwide Modern Endpoint Security Market Shares, July 2021–June 2022: Currency Exchange Rates Slightly Trimmed Accelerating Growth Michael Suby Jan 2023 |Market Share | Doc #US49982022

IDC MarketScape: Worldwide Modern Endpoint Security for Enterprises 2021 Vendor Assessment Michael Suby | Nov 2021| IDC MarketScape | Doc #US48306021

IDC Worldwide Messaging Security Market Shares, 2021: Hybrid Work Drives Need for Threat Investigation Integration | Jennifer Glenn | Jun 2022 | Market Share | Doc #US49144522

IDC Worldwide Network Security Market Shares, 2020: Storm Winds Turn to Tail Winds Christopher Rodriguez| Pete Finalle, October 2021 | Market Share | #US48205621

Gartner Market Guide for Mobile Threat Defense, Dionisio Zumerle | Chris Silva, 10 January 2023

Gartner Magic Quadrant for Endpoint Protection Platforms, Paul Webber | Peter Firstbrook | Rob Smith | Mark Harris | Prateek Bhajanka, 5 May 2021.

Gartner Critical Capabilities for Endpoint Protection Platforms, Mark Harris | Peter Firstbrook | Rob Smith | Paul Webber | Prateek Bhajanka, 6 May 2021

Gartner Market Guide for Extended Detection and Response, Craig Lawson | Peter Firstbrook | Paul Webber, 8 November 2021.

Gartner Market Guide for Data Loss Prevention | Ravisha Chugh | Andrew Bales, 19 July 2022.

Gartner Market Guide for Network Detection and Response (NDR) | Cybersecurity Research Team, 14 December, 2022.

Gartner Market Guide for Cloud Workload Protection Platforms | Neil MacDonald | Tom Croll, 12 July 2021.

Gartner Market Share Analysis: Security Software, Worldwide, Shailendra Upadhyay | Rahul Yadav | Mark Wah | Nat Smith | Swati Rakheja | Ruggero Contu | Elizabeth Kim, 20 September 2022.

Gartner Market Guide for Email Security, Mark Harris | Peter Firstbrook | Ravisha Chugh | Mario de Boer, 7 October 2021.

Gartner Peer Insights Cloud Workload Protection Platforms market

Gartner Peer Insights Email Security market

Gartner Peer Insights Intrusion Detection & Prevention Systems market

Gartner Peer Insights Endpoint Detection and Response Solutions market

Gartner Peer Insights Endpoint Protection Platforms market

Gartner Peer Insights Network Sandboxing market

Gartner Peer Insights Data Loss Prevention market

In this blog, we present findings about Trellix’s differentiated position based on the aggregated representation[1] of our XDR and native security tools in industry reports and peer review programs published by Gartner, Forrester, and IDC in the last 18 months.

Footnote:

[1] Some of these representations are based on McAfee and FireEye mentions in these reports, which now constitute Trellix’s native XDR product portfolio.

This is particularly important at a time when market conditions have affected many vendors and their layoffs were discussed publicly (e.g., Cybereason[2], Sophos[3], Microsoft[4]).

Footnotes:

2Cybereason Lays Off 10 Percent Of Workforce After Recently Filing For IPO | CRN

3Sophos Cites Downturn, MDR Shift In Disclosing Major Layoffs | CRN

4 Microsoft to cut 10,000 jobs as spending slows - BBC News

Latest from our newsroom

Get the latest

Stay up to date with the latest cybersecurity trends, best practices, security vulnerabilities, and so much more.

Zero spam. Unsubscribe at any time.